How to Use Multiple Payment Gateway Integration?

4 min

November 20, 2025

Author:

Garry

Nowadays, managing payments is not a matter of just adding one gateway and going live. Different countries have different methods of payment for customers, banks may refuse to process transactions for no apparent reasons, and some sectors, such as crypto, gaming, adult, subscriptions, and high-risk ones, suffer from more obstacles in getting approvals. This is especially true in the gaming industry, where specialized payment solutions are required to handle fast transactions, regional restrictions, high chargeback exposure, and strict compliance rules. This is the reason why most businesses today opt for multiple payment gateways instead of putting all the eggs in one basket. This practice not only allows them to have better conversion rates but also gives them more flexibility, plus a safety net in case one gateway fails or takes a long time to settle.

At PayFirmly, we see this challenge every day because we work with merchants across 40+ industries who depend on global transactions. As a payment orchestration platform, we help companies integrate multiple gateways in one place, route transactions intelligently, reduce fees, and boost approval rates by up to 15%—without dealing with complex APIs or compliance struggles. Our real-world data across e-commerce, high-risk, subscription apps, and fintech allows us to guide businesses on exactly how to build a multi-gateway setup that actually performs.

With that context, let’s understand what multiple payment gateway integration really means and why it’s becoming a standard choice for fast-growing companies.

What Is Multiple Payment Gateway Integration?

Multiple payment gateway integration means connecting your website, app, or platform to two or more payment providers instead of depending on a single gateway. Rather than routing every transaction through one PSP, you give your system the flexibility to use different gateways based on region, card type, user location, fee advantage, or fallback logic.

In simple terms:

If one gateway declines or slows down, another gateway instantly handles the payment — ensuring the customer never faces a failed checkout.

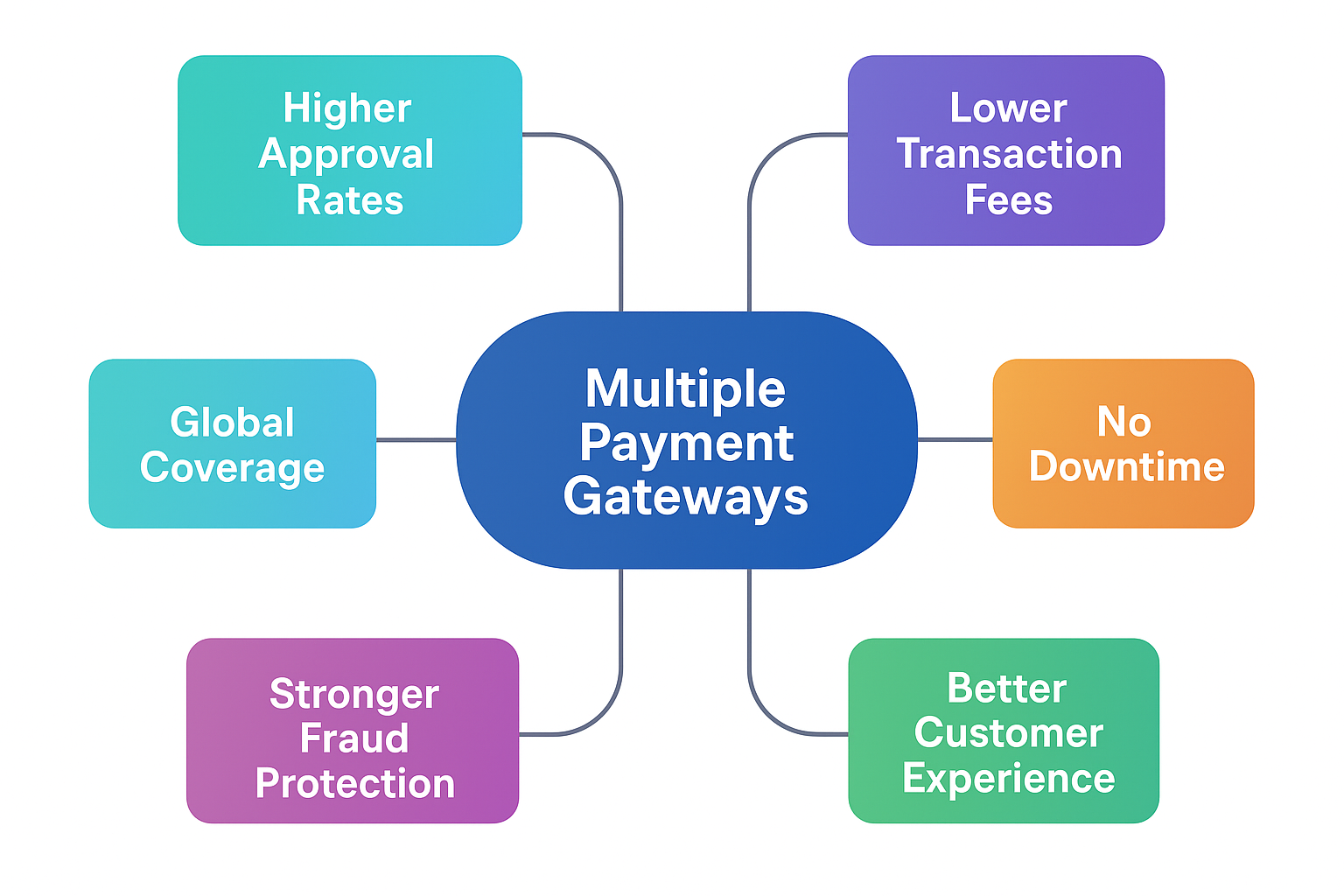

Key Benefits of Using Multiple Payment Gateways

Using multiple payment gateways is not just about adding extra options — it’s a direct advantage for revenue, approvals, fees, and customer experience. Today’s high-growth businesses rely on multi-gateway setups because a single gateway simply cannot deliver consistent performance across every market.

Below are the key benefits merchants experience when they integrate multiple gateways:

1. Higher Approval Rates (Up to 15% Increase)

Different gateways have different success rates across countries, banks, and card types. With multiple gateways, your system can instantly switch to the provider with the highest success rate — which directly boosts completed payments.

2. Lower Transaction Fees (Up to 30% Savings)

Some gateways charge higher acquiring fees, while others offer lower rates for specific card schemes or markets.

3. Global Coverage Without Restrictions

No single gateway supports every country, currency, or payment method.

Multiple gateways ensure your business can:

- Accept payments from new regions instantly

- Offer more local payment methods

- Avoid country-based blocks or risk restrictions

4. Business Continuity (No Downtime)

If one gateway faces an outage, API delay, bank issue, or compliance hold, your fallback gateway instantly handles the transaction.

5. Stronger Fraud Protection & Risk Management

Some gateways specialise in fraud screening, while others specialise in regional risk patterns. With multiple gateways, you can:

- Match each transaction with the safest gateway

- Use different fraud engines for different markets

- Reduce false declines

- Lower chargeback risk

6. Better Customer Experience

Customers prefer:

- Local payment methods

- Instant approvals

- Zero checkout friction

- Familiar payment flows

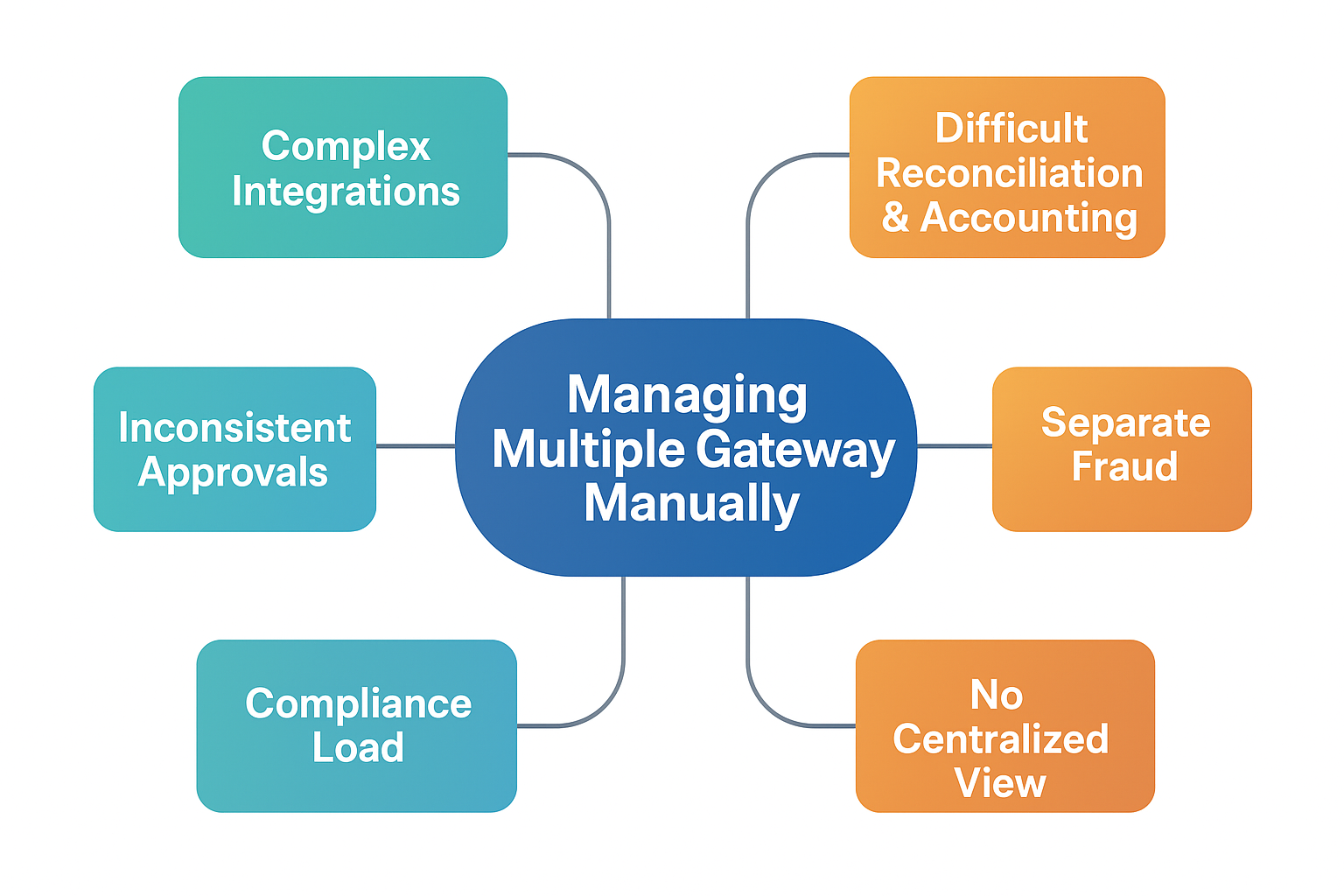

Real Challenges When Managing Multiple Gateways Manually

Using multiple payment gateways sounds powerful, but managing them manually quickly becomes a headache for most businesses. Each provider uses different APIs, documentation styles, settlement rules, and compliance requirements — turning your payment stack into a messy, time-consuming system that’s difficult to scale.

Below are the biggest challenges companies face when they try to handle everything on their own:

- Complex Technical Integrations

- Difficult Reconciliation & Accounting

- Inconsistent Approval Behaviors

- Separate Fraud Systems for Each PSP

- Compliance Load Increases

- No Centralized View or Control

Multiple Gateway Integration Options (Technical Approaches)

When businesses decide to use multiple payment gateways, the next challenge is how to integrate them. There are three main technical approaches, and each comes with its own strengths and limitations. Understanding these options helps merchants choose the best setup for their business model, volume, and global expansion needs.

Direct API Integrations (Traditional Method)

In this method, your development team integrates each payment gateway individually through its own API.

This means:

- Separate authentication keys

- Separate webhook handling

- Separate error codes

- Separate reconciliation logic

- Separate integrations for refunds, voids, and payouts

Step-by-Step Guide: How to Implement Multiple Payment Gateways

Integrating multiple payment gateways is not a plug-and-play activity. It requires a structured approach, careful testing, and a strong understanding of how each PSP behaves in different regions or during high-volume events. For many merchants, the process becomes complex very quickly — which is why businesses often prefer letting PayFirmly handle the entire setup, monitoring, routing, and optimization. If you ever feel stuck or unsure, simply contact our team and we’ll configure everything end-to-end for you.

Below is the logical step-by-step framework:

- Step 1: Identify Customer Payment Preferences (Region & Method)

- Step 2: Select 2–5 Gateways Based on Your Business Type

- Step 3: Set Up Smart Routing Rules

- Step 4: Add Fraud Screening & Risk Controls

- Step 5: Test Everything — Sandbox + Live

- Step 6: Monitor Approvals, Disputes & Settlement Behavior

Intelligent Routing: The Secret to Making Multiple Gateways Work

Adding multiple gateways is only half the job — the real power comes from intelligent routing. This is the mechanism that decides which gateway should process each transaction to ensure the highest approval rate, lowest cost, and maximum stability. Without intelligent routing, a multi-gateway setup performs no better than a single gateway.

But building a routing engine manually is complex. It requires live performance monitoring, issuer behavior analysis, real-time fallback logic, and fraud scoring. That’s why most merchants rely on PayFirmly’s orchestration engine, which automates all of this instantly.

Below are the core routing strategies that make multi-gateway systems truly effective:

Geo-Based Routing (Region + Currency Logic)

Different gateways perform better in different regions.

With geo-routing, transactions are automatically sent to the provider that performs best in:

- North America

- Europe

- Middle East

- APAC

- LATAM

Settlement & Fee Optimization With Multiple Gateways

Once businesses add multiple payment gateways, one of the biggest advantages they unlock is better control over settlement cycles and overall payment fees. Every PSP has different settlement timings, fee structures, and currency rules — and without a coordinated strategy, merchants usually end up losing money or facing cash-flow delays.

A well-managed multi-gateway setup not only reduces processing costs but also gives businesses more predictable revenue flow. This is exactly where PayFirmly’s orchestration platform adds major value.

Lower Transaction Fees by Selective Routing

Each processor charges different rates based on:

- Card scheme (Visa/Mastercard/Amex)

- Local vs international cards

- Merchant category (MCC)

- High-risk acceptance

- Volume tier

With multiple gateways, you can automatically route to the lowest fee option for each transaction. This can reduce overall cost by up to 30%, especially for high-risk and cross-border merchants.

With intelligent routing + unified settlement management, PayFirmly gives merchants full control over fees, payouts, and overall profitability — without manual effort or complex engineering.

Compliance Requirements for Multi-Gateway Setup

Once a business starts working with more than one payment gateway, the compliance responsibilities multiply. Each gateway comes with its own legal requirements, security obligations, and documentation. If merchants try to manage this manually, the workload becomes extremely heavy — especially for high-risk industries. That’s exactly why most companies prefer a payment orchestration platform like PayFirmly, which centralizes compliance and keeps your entire payment flow within global standards.

Below are the core compliance areas merchants must understand when handling multiple gateways:

1. PCI DSS Level 1 (Data Security Standard)

Any business handling card payments must meet PCI requirements.

But when you integrate multiple gateways:

- Each PSP uses different tokenization rules

- Webhooks handle sensitive data differently

- Logs, keys, and encryption must remain standardized

2. PSD2 & Strong Customer Authentication (SCA)

Merchants operating in or selling to Europe must comply with PSD2/SCA.

Every gateway handles SCA differently:

- Some use 3DS 1

- Some support 3DS 2.2

- Some require additional checks for high-risk transactions

3. GDPR & Global Data Privacy Laws

Handling customer data across multiple processors increases exposure to:

- Cross-border data transfers

- Storage inconsistencies

- Privacy risk

- Data mishandling by individual PSPs

Using one orchestration layer ensures data is:

- Controlled centrally

- Stored securely

- Shared with PSPs only when needed

- Fully compliant across regions

4. AML/KYC Requirements for High-Risk Industries

For sectors like:

- Adult

- Gaming

- Crypto

- CBD

- Fintech

5. Chargeback Management & Dispute Handling

Each gateway follows different rules for:

- Evidence submission

- Reason codes

- Filing windows

Dispute formats

6. Compliance Monitoring Across All Gateways

With multiple PSPs, merchants must monitor:

- Risk thresholds

- Decline spikes

- Fraud patterns

- Reserve changes

- Policy updates

When a Business Should Add More Gateways

Not every business needs multiple payment gateways from day one. But as you grow, expand internationally, or enter regulated industries, relying on a single gateway becomes risky and expensive. There are clear signs that indicate when it’s time to add more gateways — and ignoring them can directly affect revenue, approval rates, and customer experience.

Below are the most common scenarios where merchants should integrate additional gateways:

Entering a New Country or Region

Every country has its preferred payment methods and top-performing processors. If you're expanding into:

- US

- EU

- Middle East

- UK

- LATAM

- APAC

If you're specifically expanding into Europe, everything is covered in detail in this guide: Top Payment Gateways in Europe 2025 Guide for Businesses

Selling High-Risk Products or Services

Industries like adult, gaming, gambling, crypto, CBD, and high-risk subscriptions require multiple specialized gateways because:

- Some PSPs may restrict volume

- Some do not allow high-risk MCCs

- Some hold funds

- Some delay settlements

How PayFirmly Helps You Integrate & Manage Multiple Payment Gateways

PayFirmly acts as your complete payment orchestration layer, giving you one unified system to connect, control, and optimize all your gateways without touching any complex code.

Here’s how we make the entire multi-gateway setup effortless:

Intelligent Routing Built Into the Core

PayFirmly automatically decides which gateway should handle each transaction using:

- Geo-based routing

- Cost-based routing

- Issuer/Bank behavior

- Risk scoring

- Cascading & fallback logic

- Real-time gateway performance

This boosts approval rates by up to 15% and reduces processing costs by up to 30%.

Unified Fraud Management Across All PSPs

Instead of managing fraud rules separately for every gateway, PayFirmly gives you:

- One fraud engine

- Device/IP fingerprinting

- Behavioral scoring

- Chargeback reduction tools

- Custom risk rules

PayFirmly gives you a future-proof payment infrastructure — built for global scale, high approval rates, strong compliance, and complete operational visibility.

Merchants don’t have to hire developers, build routing engines, or manage 10 dashboards.

We take care of everything end-to-end so you can focus on growth.

Secure Crypto Payment Orchestration & Processor with PayFirmly

The future of adult payment processing is intelligent, compliant, and built around you.

Join leading adult brands using PayFirmly to boost approvals, cut fees, and simplify multi-processor management — all from one secure dashboard.

.png)