What Is Global Intelligent Payment Routing?

4 Min

December 22, 2025

Author:

Garry

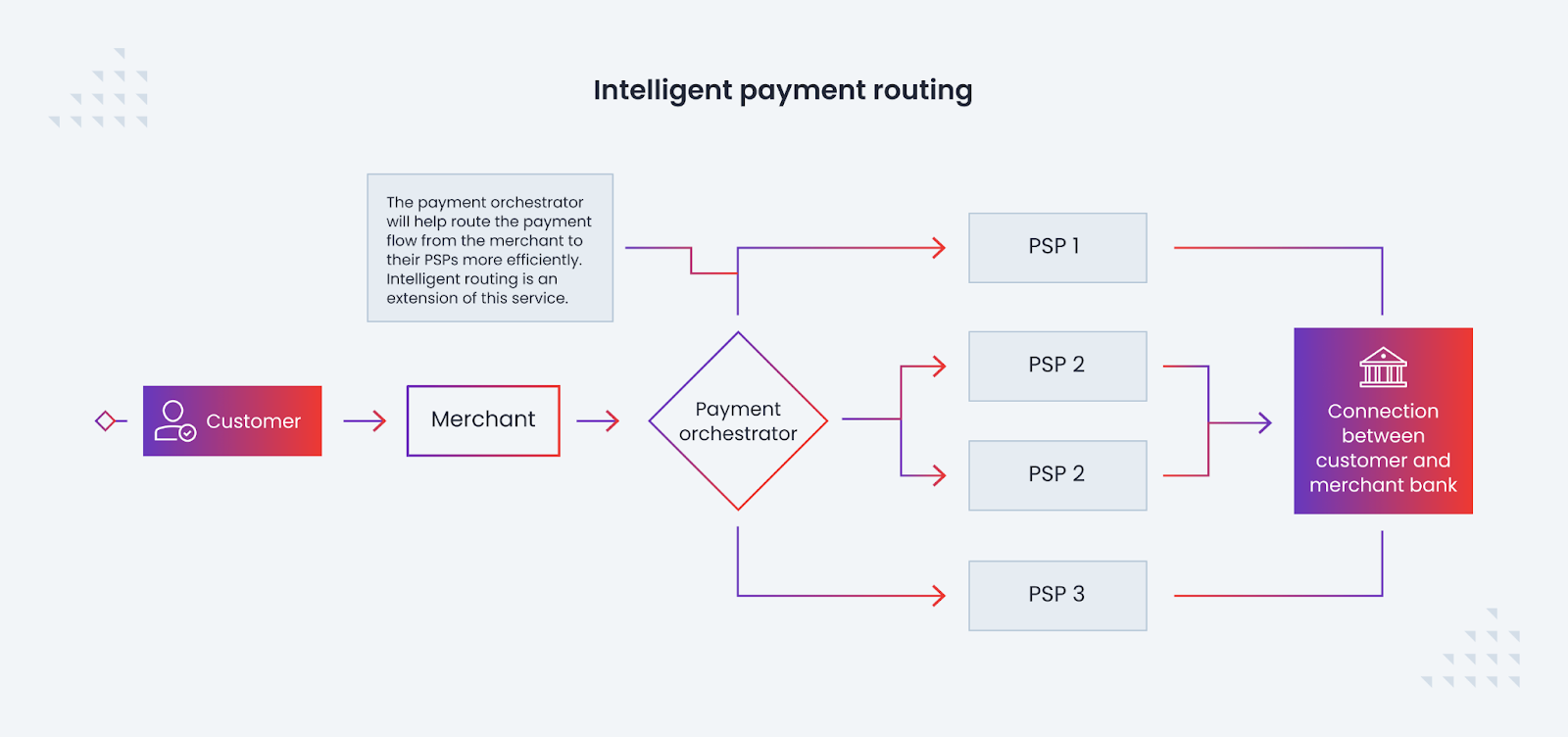

Global intelligent payment routing is a payment optimisation mechanism that automatically decides where and how a transaction should be processed to maximise approval rates, reduce failures, and maintain payment continuity across countries. Instead of sending every transaction to a single payment gateway or acquiring bank, intelligent routing evaluates each payment in real time and selects the most suitable processor, route, and payment method based on predefined rules and live performance data.

In an international context, payment behaviour varies significantly by region. A card that works smoothly in one country may fail in another due to issuer rules, currency mismatches, or cross-border risk flags. Intelligent payment routing solves this by factoring in elements such as customer location, issuing bank, currency, transaction value, risk profile, and historical success rates before routing the payment. The result is a smarter, adaptive payment flow that adjusts automatically instead of relying on static configurations.

Unlike traditional gateways that operate on a one-route-fits-all model, global intelligent payment routing is designed for scale and resilience. If one processor experiences downtime, higher decline rates, or regulatory limitations, the system seamlessly redirects traffic to an alternative route without disrupting the customer experience. This makes it especially valuable for global merchants, subscription businesses, marketplaces, and high-volume platforms where even small payment failures translate into significant revenue loss.

Platforms like PayFirmly use intelligent routing as part of a broader payment orchestration layer, allowing businesses to manage multiple processors, regions, and payment methods through a single unified setup. This approach transforms payment routing from a technical afterthought into a strategic growth tool for international operations.

Why International Businesses Need Intelligent Payment Routing

When businesses expand internationally, payments become one of the first and most complex challenges. Each country has its own issuing banks, regulatory expectations, preferred payment methods, and risk thresholds. A payment flow that performs well in one market can fail consistently in another. This is why international businesses cannot rely on a single processor, or even a basic payment gateway for international transactions, if they want consistent results at scale.

One of the most common issues global merchants face is cross-border card decline. Payments routed through non-local acquirers are more likely to be rejected due to currency mismatches, issuer restrictions, or additional fraud checks. Intelligent payment routing reduces these failures by dynamically directing transactions to region-appropriate processors, significantly improving approval rates and customer checkout success.

International operations also involve diverse payment preferences. While cards dominate in some regions, others rely heavily on local bank transfers, wallets, or alternative methods. Intelligent payment routing enables businesses to prioritise the most effective payment method for each market instead of forcing a one-size-fits-all checkout.

For global platforms, marketplaces, and subscription-based services, payment reliability directly impacts growth. By using an orchestration-based approach like PayFirmly, businesses gain the flexibility to adapt payment flows by country, currency, and risk profile — ensuring payments remain stable as they scale across borders.

Key Features of Global Intelligent Payment Routing

Global intelligent payment routing is built around a set of core features that allow international businesses to process payments more reliably, efficiently, and at scale. These features work together to ensure each transaction follows the most effective path instead of relying on a fixed or single-gateway setup.

One of the most important features is real-time processor selection. Every transaction is evaluated instantly and routed to the processor with the highest likelihood of approval based on region, currency, transaction size, and historical success data. This prevents unnecessary declines that commonly occur with static routing models.

Automatic failover and redundancy are also central to intelligent routing. If a processor experiences downtime, regulatory limitations, or sudden decline spikes, transactions are automatically rerouted to backup processors without affecting the customer checkout experience.

Intelligent routing systems also support currency-aware processing, allowing transactions to be routed in local currencies. This not only improves approval rates but also reduces customer confusion and abandonment caused by unexpected currency conversions.

Another essential feature is risk-aware routing. Transactions with higher risk profiles can be sent through processors that are better suited to handle them, while low-risk payments are routed through cost-optimised paths. This balance helps reduce false declines while maintaining fraud controls.

When implemented through an orchestration platform like PayFirmly, these features operate under a unified system, giving businesses full visibility and control over global payment flows without adding operational complexity.

How Intelligent Payment Routing Works (Step-by-Step)

Step 1: Payment is initiated at checkout

A customer starts a transaction using a card, wallet, bank transfer, or crypto. At this moment, the system captures key inputs such as country, currency, device data, transaction amount, and payment method.

Step 2: Real-time transaction analysis

Before sending the payment anywhere, the routing engine analyses multiple parameters—customer location, issuing bank, currency compatibility, risk signals, and historical approval data. This happens in milliseconds and does not slow down checkout.

Step 3: Routing decision by the intelligence layer

Based on predefined rules and live performance metrics, the system selects the processor and route with the highest probability of success. For example, a European card may be routed to a local EU acquirer, while a higher-risk transaction may be sent to a processor with better tolerance.

Step 4: Transaction processing

The payment is submitted to the selected processor. If approved, the transaction completes seamlessly and the customer experiences a normal checkout flow.

Step 5: Automatic retry or failover (if needed)

If the transaction fails due to a soft decline, technical issue, or processor limitation, the system can automatically retry via an alternative route—without asking the customer to re-enter details.

Step 6: Performance feedback and optimisation

Every success and failure is logged. Over time, the routing engine learns which routes perform best by region, currency, and risk type, continuously optimising future decisions.

When this workflow is implemented through an orchestration platform like PayFirmly, businesses manage all routing logic, processors, and payment methods from one central system. This turns payment routing into a self-optimising process that improves approval rates and protects revenue as volumes and geographies expand.

International Intelligent Payment Routing Use Cases

International intelligent payment routing is not limited to a single business type. It becomes critical anywhere transactions cross borders, currencies, or regulatory frameworks. Below are some of the most common real-world use cases where intelligent routing directly improves payment performance and revenue stability.

Global eCommerce businesses rely on intelligent routing to reduce cross-border card declines. By routing payments through local or regional acquirers based on customer location, these businesses see higher approval rates and fewer abandoned checkouts, especially in Europe, Asia, and Latin America.

Subscription and SaaS platforms face recurring payment failures due to issuer rules, expired cards, or regional risk controls. Intelligent routing helps by retrying failed transactions through alternative processors or payment methods, reducing involuntary churn and protecting monthly recurring revenue.

Marketplaces and platforms operating across multiple countries benefit from region-specific routing. Sellers and buyers may be located in different jurisdictions, and intelligent routing allows each transaction to follow the most compliant and cost-effective path without creating separate checkout systems for each market.

High-risk and regulated industries, such as gaming, adult services, supplements, or crypto payments, depend heavily on routing intelligence. These businesses often face sudden processor restrictions or increased decline rates. Intelligent routing distributes transactions across multiple compliant processors, reducing dependency risk and maintaining continuity.

Travel, ticketing, and cross-border service businesses use intelligent routing to handle international cards and alternative payment methods more effectively. Routing transactions locally where possible helps avoid issuer declines that commonly occur with foreign card processing during international bookings.

Benefits of Intelligent Payment Routing for Global Merchants

For merchants operating internationally, intelligent routing transforms payments from a bottleneck into a growth enabler. When implemented through an orchestration layer like PayFirmly, these benefits scale automatically as transaction volumes, regions, and payment methods increase.

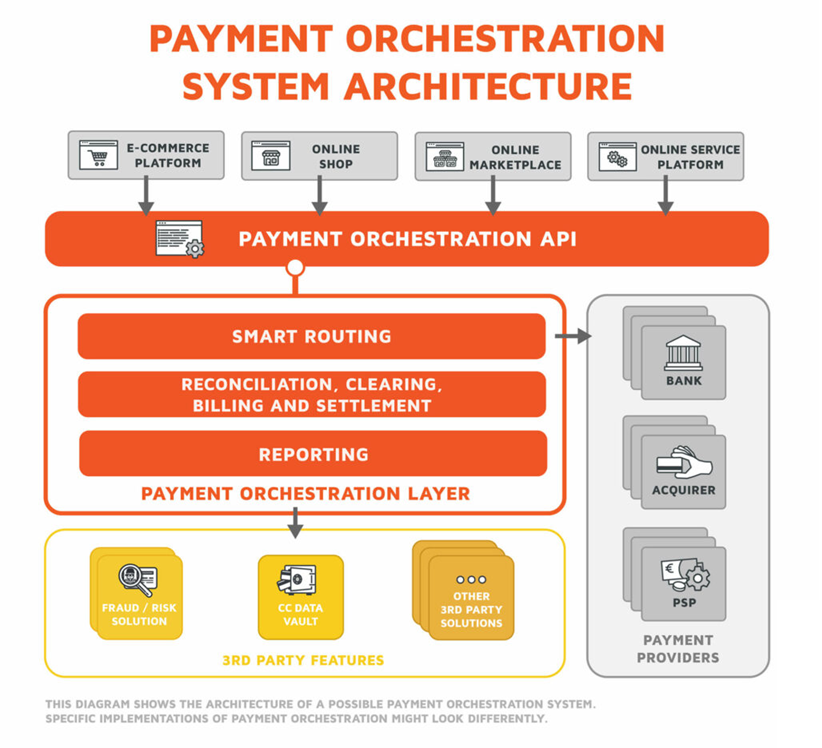

PayFirmly Payment Orchestration Enables Intelligent Routing

Payment orchestration is the foundation that makes intelligent payment routing possible at a global scale. Without orchestration, routing logic is limited, rigid, and often tied to a single processor. Orchestration introduces a central control layer that connects multiple payment processors, acquiring banks, and payment methods into one unified system, allowing routing decisions to be made dynamically instead of manually.

PayFirmly combine orchestration and intelligent routing into a single infrastructure layer. This allows global merchants to manage multiple processors, regions, and payment methods from one system while continuously improving approval rates and payment stability. In practice, payment orchestration turns intelligent routing from a feature into a scalable payment strategy that supports long-term international growth.

Secure Crypto Payment Orchestration & Processor with PayFirmly

The future of adult payment processing is intelligent, compliant, and built around you.

Join leading adult brands using PayFirmly to boost approvals, cut fees, and simplify multi-processor management — all from one secure dashboard.