Paysafe Payment Gateway vs Payment Processor: A Merchant-Focused Comparison

4 Min

December 8, 2025

Author:

Garry

Most merchants hear the terms payment gateway and payment processor and assume both mean the same thing — until they start facing declines, settlement delays, or regional restrictions. Paysafe is often positioned as a full-stack payment solution, but its role as a gateway is very different from what an actual payment processor or acquiring network does behind the scenes. As a merchant, knowing the difference can directly impact your approval rates, fees, compliance risks, and global expansion strategy.

At PayFirmly, we work with merchants across e-commerce, gaming, adult, crypto, subscriptions, and other high-risk verticals, so we see these challenges every day. We regularly help businesses decide when to use a gateway like Paysafe, when to connect additional processors, and when to implement orchestration for better control. This gives us a front-row view of how gateways and processors behave in real transactions — and more importantly, how merchants should choose between them to reduce declines and scale globally.

What Is a Payment Gateway? (Explained With Paysafe Example)

We’ve explained what a payment gateway is many times in our previous blogs, but for new readers, here’s a quick, simplified version. A payment gateway is the digital “bridge” that carries a customer’s payment details from your website or app to the backend systems that authorize the transaction. It encrypts card data, performs initial fraud checks, and passes the information securely to a payment processor or acquiring bank. If you want a deeper, step-by-step explanation, you can always refer to our earlier detailed articles on this topic.

Paysafe works primarily as a payment gateway in this flow. It helps merchants accept online payments, tokenize card details, and meet PCI compliance requirements. But Paysafe does not approve transactions and does not settle funds into your account — those critical steps are performed by the underlying processor or acquiring bank behind it. Many merchants assume a gateway controls the full payment outcome, but in reality, the processor determines whether a transaction succeeds or fails.

Also Checkout: What are Different Types of Payment Gateways?

This distinction becomes very clear when merchants experience unexpected declines. The gateway may have transmitted everything correctly, but the processor might still reject the payment due to issuer rules, region restrictions, or risk filters. This is why relying on a single gateway setup often limits performance — and why high-volume merchants eventually pair gateways with multiple processors for better control and higher approvals.

What Is a Payment Processor? How It Differs From a Gateway

If the payment gateway is the “front door,” the payment processor is the engine room where the actual approval decision happens. A processor communicates directly with issuing banks, card networks, and acquiring banks to determine whether a transaction should be accepted, declined, flagged for risk, or routed for additional verification. This is the part of the payment chain that truly controls your approval rates, settlement timelines, chargeback handling, and overall revenue flow.

A payment processor handles tasks such as:

- Communicating with card networks like Visa, Mastercard, Amex

- Applying risk filters, velocity rules, and region-specific compliance

- Approving or declining a transaction

- Settling funds to your merchant account

- Managing refunds, reversals, and chargebacks

- Handling multi-currency conversions and cross-border routing

This is where the difference becomes significant for merchants using Paysafe or any other gateway. A gateway simply transmits the transaction; a processor analyzes, approves, and settles it.

For a deeper breakdown of how gateways, processors, and orchestration layers work together, you can explore our detailed guide here: Payment Gateway vs Processor vs Orchestration

So even if the gateway performs perfectly, a strict or region-mismatched processor can still decline the payment. That’s why two merchants with the same gateway often see very different results — because their processors are not the same.

In our daily work at PayFirmly, we see businesses facing issues like high decline ratios in certain countries, slow settlement cycles, or blocked card types. In almost every case, the root cause is not the gateway at all — it’s the processor behind it. This is exactly why high-growth merchants eventually diversify their processors or use an orchestration layer to balance traffic intelligently.

Paysafe Payment Gateway vs Payment Processor — Key Differences for Merchants

Many merchants feel Paysafe is a “complete payment solution,” but in reality, Paysafe mainly acts as a payment gateway, not a full processor. To make things easy to understand, here is the basic difference:

A gateway (like Paysafe)

- Collects customer payment details

- Encrypts and sends the data safely

- Does basic fraud checks

- Forwards the transaction to the processor

A payment processor

- Talks to the bank and card networks

- Approves or declines the payment

- Handles settlement of funds

- Manages refunds and chargebacks

- Controls most of your payment performance

So even if Paysafe works well as a gateway, the final approval still depends on the processor behind it. Many merchants get confused because declines often look like a gateway issue, but the decision usually comes from the processor or the issuing bank.

Paysafe Payment Gateway vs Payment Processor

Here is a simple, clear comparison table showing how a payment gateway differs from a payment processor, and why both matter for your approval rates, fraud control, and settlement performance.

If you're scaling globally or working in high-risk categories, see how PayFirmly helps you combine multiple processors for higher approval rates.

Where Paysafe Works Best — And Where It Falls Short

Paysafe is a well-known name in online payments, and for many merchants, it works smoothly as a payment gateway. But like every gateway, it has areas where it performs well and areas where merchants usually face limitations. Understanding this helps you decide whether Paysafe alone is enough or if you need additional processors or orchestration.

Where Paysafe Works Well

Paysafe usually performs well in the following situations:

- Low to medium-risk industries like retail, digital goods, and standard eCommerce

- Merchants selling mainly in Europe and North America, where their partner processors have strong coverage

- Businesses needing simple integration without too many advanced routing or compliance layers

- Merchants with stable traffic who don’t need multiple processors or fallback options

- Subscriptions and recurring billing models where tokenization and fraud checks matter

For these types of businesses, Paysafe provides good stability and a clean payment flow.

Where Paysafe Falls Short

However, many merchants eventually hit limits, especially when they start scaling globally or move into high-risk categories. Common challenges include:

- High decline rates in regions where Paysafe's connected processors are weak

- Limited support for high-risk industries such as gaming, adult, forex, crypto, CBD, or nutraceuticals

- Lack of control over routing — you cannot choose which processor should handle the transaction

- Slow settlements depending on the acquiring bank behind Paysafe

- Strict compliance filters that sometimes reject good payments

- No backup processor — if one processor goes down, your business stops accepting payments

We see these issues almost daily when merchants come to PayFirmly after struggling with a single-gateway setup. Gateways like Paysafe are good, but they don’t give full control, especially when you want to scale across countries or industries with higher risk.

This is why most growing merchants eventually look for a setup that includes multiple processors + payment orchestration rather than depending only on one gateway.

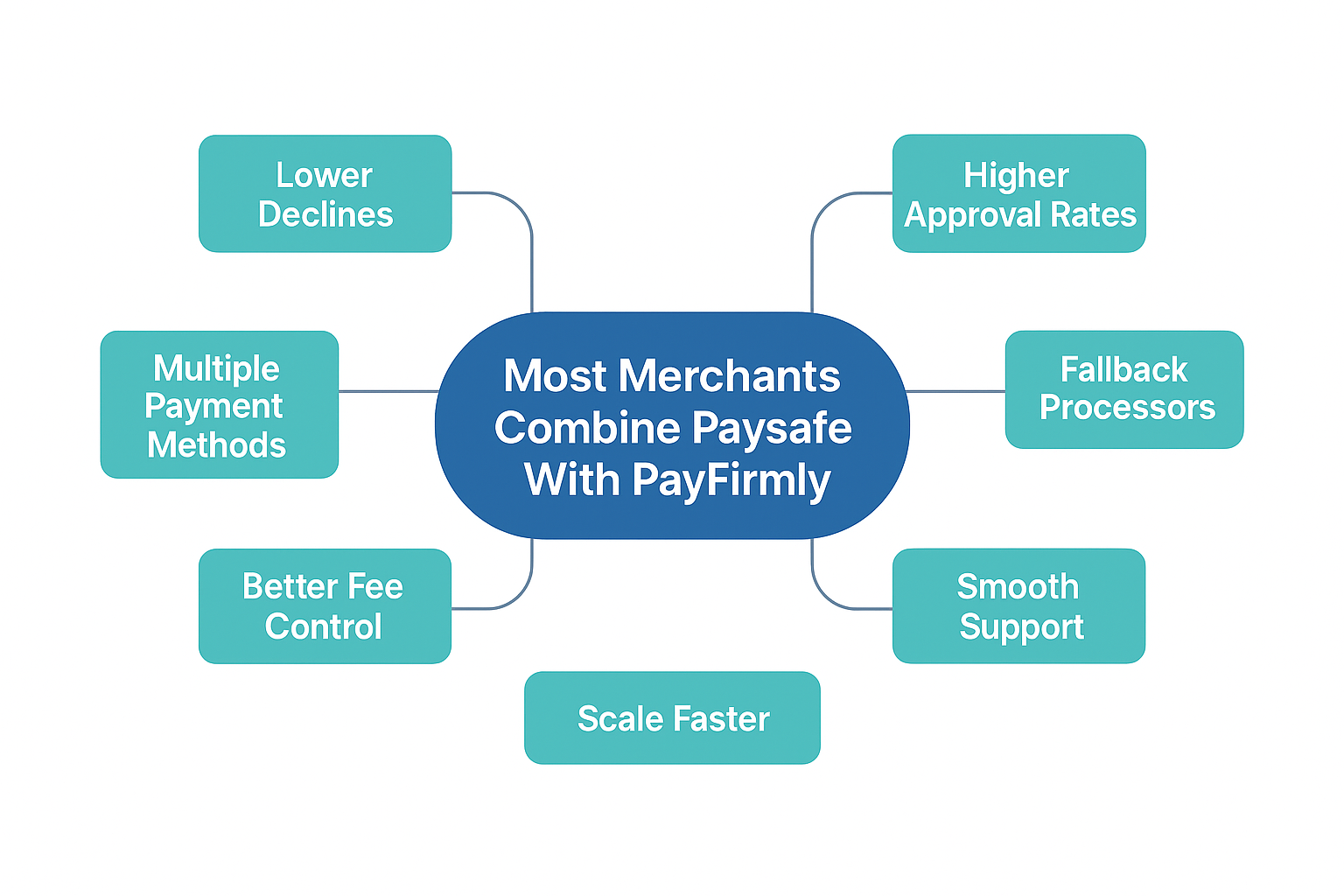

Why Most Merchants Combine Paysafe With PayFirmly Payment Orchestration

Many merchants start with Paysafe because it is easy to integrate and reliable as a gateway. But once the business grows — new countries, new payment methods, higher volumes, or high-risk categories — they quickly realise that a single gateway cannot support long-term scaling. This is where PayFirmly’s payment orchestration platform becomes the missing layer that completes the setup.

At PayFirmly, we connect Paysafe with multiple processors, local acquirers, alternative payment methods, crypto gateways, and fallback routes. This gives merchants the flexibility and control that Paysafe alone cannot provide.

Here’s why most merchants choose to combine both:

1. Lower Declines With Smart Transaction Routing

If Paysafe’s processor declines a payment, PayFirmly can automatically reroute the same transaction to a better-performing processor or local acquirer. This helps merchants recover sales that would otherwise be lost.

2. Higher Approval Rates in International Markets

Some countries need local processing.

PayFirmly adds region-focused processors, so payments that fail through Paysafe often get approved through another acquirer.

3. Multiple Payment Methods Beyond Paysafe’s List

With PayFirmly, merchants can add:

- UPI

- Local wallets

- Bank transfers

- Crypto Payment Processing Services

- Regional APMs (Brazil, EU, Asia, Middle East)

This is especially powerful for global or high-growth merchants.

4. Fallback Processors When Paysafe Goes Down

If Paysafe faces downtime or network issues, PayFirmly automatically shifts traffic to backup providers — so your business doesn’t stop.

5. Better Fee Control & Cost Optimisation

PayFirmly compares processor fees and routes payments to whichever option is more cost-efficient for that transaction type, country, or card network.

6. Smooth Support for High-Risk Industries

Paysafe alone may decline high-risk merchants (adult, gaming, crypto, CBD, subscription billing).

PayFirmly brings verified high-risk processors that complement Paysafe’s coverage.

7. Central Dashboard for All Payments

Instead of checking Paysafe, processors, wallets, and banks separately, you get one unified PayFirmly dashboard for:

- Reporting

- Settlements

- Fraud data

- Chargebacks

- Performance insights

8. Scale Faster Without Rebuilding Your Payment System

No need to replace Paysafe — PayFirmly simply adds more processing power and flexibility around it.

Real Merchant Scenarios — When to Use Gateway vs Processor

Every merchant has a different payment setup, and the right choice depends on the business model, risk level, and target countries. Below are simple, real-world examples that show when a gateway like Paysafe is enough, when a payment processor becomes important, and when PayFirmly’s orchestration makes a big difference.

Scenario 1: A Standard E-commerce Store Selling Mostly in the US & Europe

A small or mid-size retail website selling in stable markets may not need multiple processors in the beginning.

Here, Paysafe as a gateway works well because:

- Traffic is stable

- Risk level is low

- Processors behind Paysafe already support these regions

But once the merchant starts selling globally, they usually see higher declines. This is the point where they add additional processors through PayFirmly.

Scenario 2: A Subscription Business With Recurring Payments

Subscription merchants depend heavily on card retries, tokenization, and low friction.

Paysafe supports this well as a gateway, but processor behaviour decides renewal success.

If the processor is too strict, recurring payments fail even when the customer has funds.

PayFirmly helps by routing subscription renewals through:

- Better domestic processors

- Cheaper acquirers for repeat billing

- Processors with soft declines and retry support

This improves renewal success rates.

Scenario 3: A High-Risk Merchant in Adult, Gaming, Crypto, or CBD

In these industries, relying only on Paysafe usually fails because:

- Their processors decline high-risk traffic

- Settlements become slow

- Chargeback rules are strict

Here, the merchant needs specialised processors + PayFirmly orchestration to manage:

- High-risk approvals

- Fraud scoring

- Chargebacks

- International traffic

Paysafe alone cannot support these verticals effectively.

These scenarios clearly show that Paysafe is useful, but not enough for scaling, especially when approvals, risk, or international markets become important.

This is where PayFirmly becomes the real game-changer for merchants.

What’s the Best Choice for Merchants?

Paysafe is a strong payment gateway and works well for many businesses, especially in low-risk categories and stable markets like the US and Europe. But once a merchant starts growing, enters high-risk verticals, or targets global customers, the limits of a single gateway become clear. Approval rates start dropping, settlements become inconsistent, and there is no backup option if the connected processor refuses transactions.

A payment processor, on the other hand, controls the real decision-making — approvals, declines, settlements, chargebacks, and fees. This is why two merchants with the same gateway often get very different results. The processor behind the gateway decides how your payments behave.

For most scaling businesses, the ideal setup is not “gateway vs processor,” but a combined system where the gateway works together with multiple processors through an orchestration layer. This is exactly what PayFirmly provides. We help merchants use Paysafe more effectively by adding extra processors, improving approval rates, reducing costs, and giving full control over payment routing.

If you want to grow globally, handle high volumes, reduce declines, or operate in high-risk merchants, PayFirmly becomes the smarter choice. You keep Paysafe — but you gain the power, flexibility, and performance that a gateway alone cannot deliver.

Secure Crypto Payment Orchestration & Processor with PayFirmly

The future of adult payment processing is intelligent, compliant, and built around you.

Join leading adult brands using PayFirmly to boost approvals, cut fees, and simplify multi-processor management — all from one secure dashboard.

.png)