CoinGate vs NOWPayments vs Inqud: Full Features, Fees & Reliability Comparison for Merchants

4 Min

November 17, 2025

Author:

Garry

The choice of the right cryptocurrency payment processor is no longer just a technical decision; it now directly affects approval rates, settlement speed, compliance, and even the overall customer experience. Today’s merchants want a payment partner who can offer stability, clear and predictable fees, global support, and the confidence that their business will not be disrupted by sudden rule changes or the shutdown of high-risk sectors.

That’s exactly why comparisons like CoinGate vs NOWPayments vs Inqud matter. All three providers claim to offer fast crypto payments, support for many currencies, and worldwide access but their real performance, reliability, fees, compliance strength, and overall business fit can be very different.

Why Most Merchants Prefer PayFirmly Over CoinGate, NOWPayments, and Inqud

As a global payment orchestration company, PayFirmly works with hundreds of merchants across e-commerce, crypto, gaming, VPN, adult, and other high-risk sectors. So we regularly evaluate processors like CoinGate, NOWPayments, and Inqud from a merchant’s perspective not from marketing claims, but from actual transaction behavior, approval data, settlement experience, and compliance requirements. Now let's get back to the topic…

By means of this comparison, I will analyze the features, charges, integrations, dependability, compliance tools, and for which type of business each of the three platforms is suited to help you deduce which one is the best match for your needs. More significantly, I will inform you about the position of these processors in your payment stack and when routing them via PayFirmly, you get better reliability, more approvals, and safer scaling.

Let us take a closer look at the real offering of each platform.

Where CoinGate, NOWPayments & Inqud Actually Stand for Merchants

Most merchants don’t just need a crypto gateway they need a payment partner that stays stable, compliant, and scalable even when transaction volumes increase or regulations tighten. This is where the real differences between CoinGate, NOWPayments, and Inqud start to appear. Each of these platforms has strengths, but they also come with limitations that directly affect how fast you can accept payments, how quickly you receive settlements, and how confidently you can operate in high-risk or cross-border environments. In this comparison, I’m breaking down their core capabilities so you can understand not just what they claim, but how they actually perform for merchants running real businesses.

CoinGate: What It Offers and Where It Fits for Merchants

CoinGate is one of the more established crypto payment gateways, and it’s built around simplicity, global reach, and compliance-heavy crypto processing. Merchants use it mainly because of its wide cryptocurrency support, chargeback-free checkout, instant fiat settlement options (EUR, USD, GBP), and built-in AML/KYC tools. From a business perspective, CoinGate works well for companies that want a plug-and-play crypto checkout with predictable 1% fees and a straightforward settlement pipeline. However, its strengths come with a few constraints — especially around customization, recurring payments, enterprise-level flexibility, and high-volume optimization areas where many scaling merchants eventually start looking for alternatives or additional routing layers like PayFirmly.

NOWPayments: Simple, Lightweight, and Designed for Small Businesses

NOWPayments positions itself as a lightweight, user-friendly crypto payment gateway built for small online businesses that want quick onboarding and minimal technical setup. Its biggest strengths are ease of use, a clean dashboard, and support for a wide range of cryptocurrencies without requiring merchants to handle wallets manually. Many small merchants choose NOWPayments because of its simple API, no-code payment buttons, and straightforward checkouts that work well for low-volume stores or creators.

However, NOWPayments has a few notable limitations when compared to enterprise-grade needs. Its review volume is much lower, long-term product direction is rated weaker by merchants, and it lacks the deeper compliance, treasury, and recurring billing infrastructure that high-risk or fast-scaling businesses require. Because of this, NOWPayments is good as an entry-level gateway but when merchants need higher approval rates, better reliability, or multi-processor routing, they usually begin exploring platforms like PayFirmly for more stability and scalability. Many merchants exploring scalable options also compare NOWPayments alternatives to evaluate reliability, compliance readiness, and cost-efficiency.

Inqud: Customizable Crypto Infrastructure for Web3, SaaS & High-Risk Industries

Inqud markets itself as a customizable crypto payment infrastructure rather than a simple gateway. Its strengths lie in tailor-made payment flows, multi-chain support (ETH, SOL, TRX, ARB, OP, BTC), and a licensed, security-audited setup that appeals to fintech platforms, SaaS products, payment service providers, and even iGaming operators. What makes Inqud stand out is its ability to integrate custom tokens, build bespoke checkout solutions, enable recurring Web3 billing, and offer 0% transfer commissions features that attract platforms needing deeper blockchain-native functionality.

But while Inqud is flexible, it’s also heavily sales-driven. There is no transparent public pricing, most features require consultation, and settlement structures depend on custom agreements. For small or mid-sized merchants expecting instant activation, Inqud can feel more enterprise-oriented and less plug-and-play. And for merchants handling high volumes or multi-country acquisitions, relying solely on a single crypto provider introduces compliance and downtime risk a gap PayFirmly solves by orchestrating multiple processors, routing transactions intelligently, and keeping your business stable even if one provider faces delays or restrictions.

CoinGate vs NOWPayments vs Inqud — Comparison Table

Below is a quick comparison snapshot to help you identify which solution aligns best with your operational and compliance needs.

Fees & Settlement: Which One Is More Cost-Efficient?

When merchants evaluate a crypto payment provider, fees and settlement speed become the most sensitive metrics. Even a small change in processing cost or settlement timing can impact your margins, cash flow, and the overall stability of your payment operations. CoinGate, NOWPayments, and Inqud all claim to offer “low-cost” crypto acceptance — but their pricing structures and settlement behaviors are very different in real-world scenarios.

CoinGate is the only one among the three with publicly transparent pricing. Their standard 1% per transaction fee makes it predictable for merchants, and the ability to instantly settle into EUR, USD, or GBP removes volatility risk. For businesses operating in regulated countries or with accounting-heavy operations, this transparency is a major advantage.

NOWPayments, on the other hand, lacks clear public pricing for most currencies and transaction types. While it’s generally affordable for small merchants, the absence of a fixed public structure means costs can vary based on volume, coin type, or integration method. This is fine for low-volume use cases, but not ideal for merchants who need predictable operating costs.

Inqud takes a completely custom approach. Pricing is quote-based, determined only after a sales consultation, and tailored to your industry, volume, risk level, and integration type. It’s flexible, but it can also lack clarity for merchants wanting instant onboarding. However, Inqud stands out with 0% internal transfer fees and no monthly charges, which can benefit fintechs, PSPs, and Web3 platforms managing multiple internal transactions.

From a settlement perspective, CoinGate offers one of the more reliable structures for fiat withdrawals, while NOWPayments and Inqud are stronger in crypto-native flows. But the biggest limitation across all three is that they operate as single providers — meaning any slowdown, compliance review, or network issue directly affects your cash flow.

That’s why many merchants prefer routing these crypto payment gateway options through PayFirmly, where transactions can be balanced, optimized, and dynamically redirected to whichever processor is the cheapest, fastest, or least congested at that moment.

Reliability & Performance Comparison

For any merchant processing global payments especially in high-risk or high-volume environments reliability is everything. A gateway may look good on paper, but what truly matters is how it behaves during peak traffic, volatile market conditions, regional restrictions, or compliance reviews. When analyzing CoinGate, NOWPayments, and Inqud from a performance angle, each shows clear strengths along with noticeable operational limitations.

CoinGate is generally viewed as the more stable and mature platform among the three. With a larger user base, more public reviews, stronger support ratings, and better product direction scores, CoinGate performs reliably for merchants processing consistent crypto volumes. It offers fast conversion, relatively predictable settlement behavior, and stable uptime — a reason why VPNs, hosting companies, and digital service providers stick with it. However, when traffic surges or blockchains congest, single-provider processing still creates bottlenecks.

NOWPayments performs well for small merchants who need simple payment acceptance without heavy transaction pressure. Users appreciate its easy setup and clean UI, but its long-term product roadmap and support scores are notably weaker than CoinGate’s. Lower review volume also makes it harder to predict reliability for enterprise-scale businesses. It works well as a supporting payment option, but not as the core processor for businesses with thousands of daily transactions.

Inqud positions itself as an enterprise-grade infrastructure, and its reliability reflects that. With 24/7 personal support managers, multi-chain flexibility, security audits, and licensed operations, Inqud is designed for businesses that require operational stability and scalability. That said, its custom nature means performance can vary depending on the specific setup and agreement some merchants may get premium support levels, while others depend heavily on negotiated SLAs.

The biggest limitation across all three remains the same:

They are single points of failure.

If CoinGate experiences delays, NOWPayments faces API issues, or Inqud performs a compliance update, your entire payment flow can stall. And this is exactly why more merchants use PayFirmly as an orchestration layer automatically distributing traffic between processors, optimizing routes, and ensuring you’re never dependent on one gateway’s internal performance or downtime.

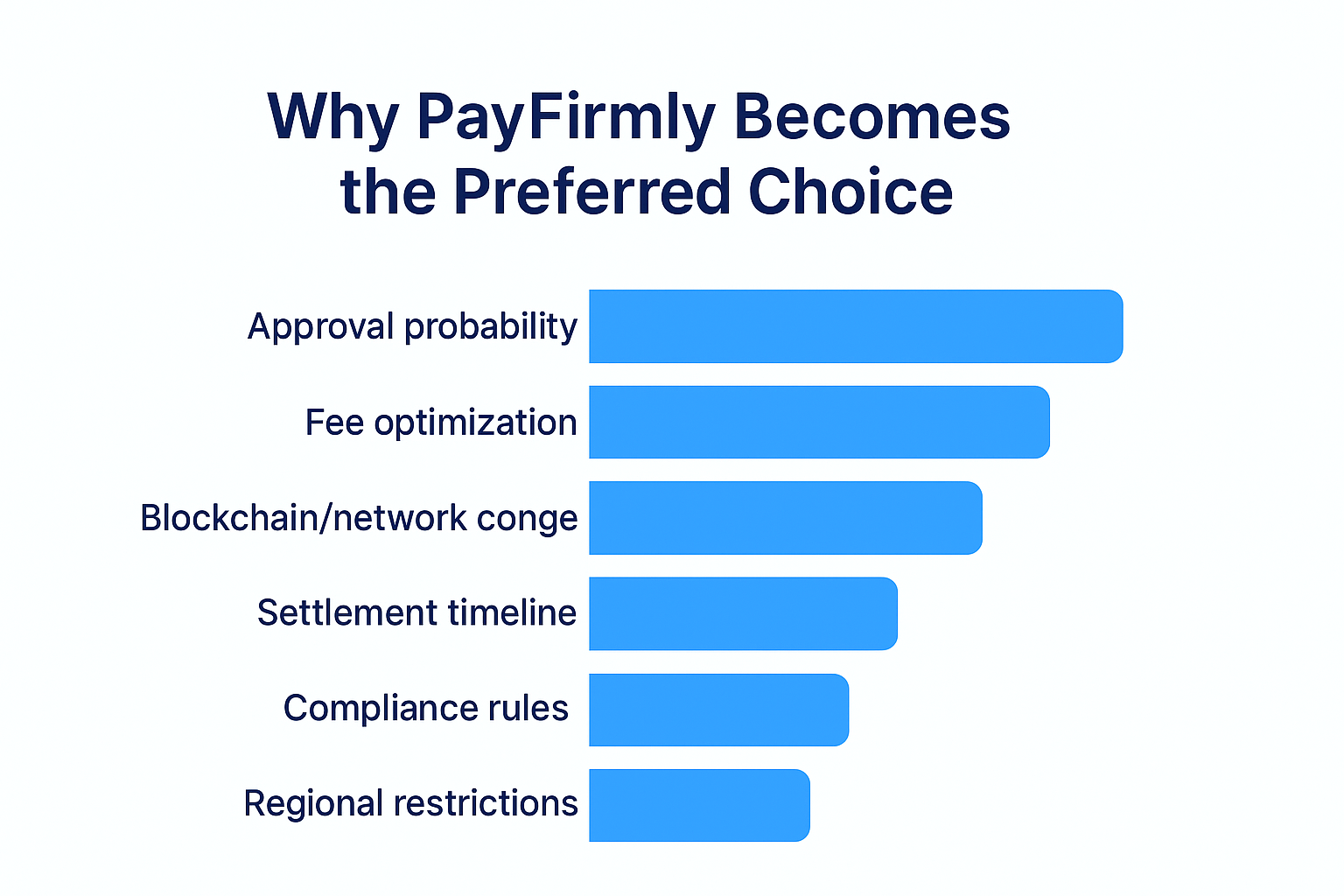

Why PayFirmly Becomes the Preferred Choice

Merchants choose PayFirmly not because CoinGate, NOWPayments, or Inqud are weak but because relying on just one of them is not enough for long-term growth. As a global payment orchestration company, PayFirmly connects you to multiple crypto and fiat processors at the same time, allowing every transaction to take the best possible route based on:

- Approval probability

- Fee optimization

- Blockchain/network congestion

- Settlement timeline

- Compliance rules

- Regional restrictions

- Processor uptime

Instead of depending on one gateway’s behavior, PayFirmly ensures continuous, uninterrupted processing even if any single provider goes down, delays payout, or temporarily blocks a region or industry.

With PayFirmly, merchants get:

- Higher approval rates through intelligent routing

- Lower fees by choosing the most cost-efficient processor

- Better compliance and safety with multi-layer checks

- Faster settlements across fiat & crypto providers

- Complete redundancy to protect revenue from downtime

- One unified dashboard to manage everything

CoinGate, NOWPayments, and Inqud are good tools but PayFirmly is the infrastructure that makes them reliable, scalable, and profitable for merchants who can’t afford disruption. To understand how orchestration compares with traditional processors, you can explore the different types of payment gateways and how each functions within a modern payment stack.

Final Comparison Summary

A detailed comparison of CoinGate, NOWPayments, and Inqud shows that they are suited for different kinds of merchants. CoinGate is the one that catches attention for its clear-cut pricing, powerful compliance measures, and dependable fiat settlements. Small merchants looking for an easy-to-use crypto payment gateway with little to no installation can opt for NOWPayments. Inqud is aimed at developing tailored, enterprise-level crypto infrastructure that has multi-chain and Web3 functionalities.

However, they all share one critical limitation:

They operate as single payment gateways.

When your entire payment flow depends on one provider, any API delay, compliance review, liquidity issue, region block, blockchain congestion, or internal policy update directly stops your cash flow. This risk becomes even more serious in high-risk industries like gaming, VPN, adult, digital goods, or any fast-scaling online platform handling thousands of transactions.

At that point, the distinction becomes very obvious not concerning the individual offerings of each provider but rather the things that they cannot provide by themselves:

Redundancy, routing logic, multi-processor reliability, and compliance-safe stability across regions

Secure Crypto Payment Orchestration & Processor with PayFirmly

The future of adult payment processing is intelligent, compliant, and built around you.

Join leading adult brands using PayFirmly to boost approvals, cut fees, and simplify multi-processor management — all from one secure dashboard.

.png)